Wellby Secure Spending

A free high yield checking account with premium perks

Free High Yield Checking, Premium Perks

Our Secure Spending checking account gives you more flexibility with added benefits and services.

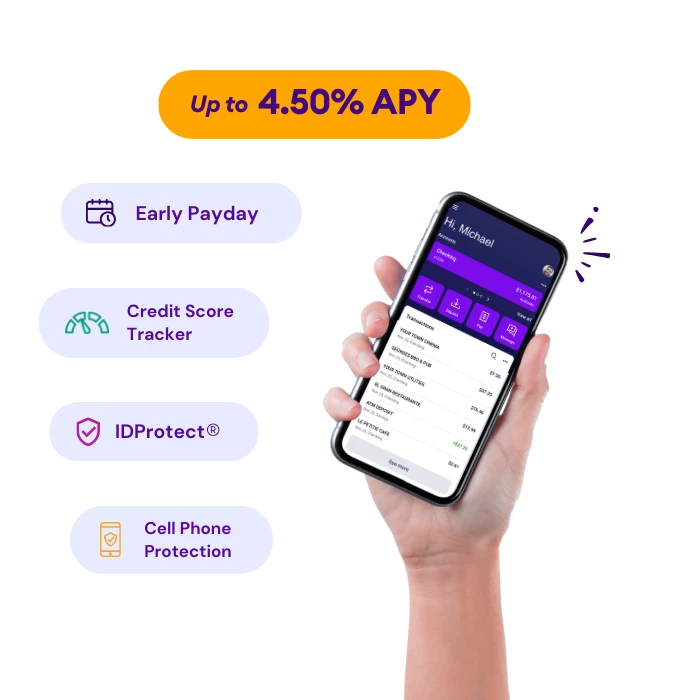

- High Yield Advantage1: Earn up to 4.50% APY on Secure Spending balances up to $50,000 by making 30 point-of-sale (POS) Wellby Debit or Credit Card transactions monthly.

- No Monthly Service Fees: Your money stays with you – where it belongs.

- Early Payday2: Celebrate payday up to 2 business days early at no extra charge.

- Save the Change with a Wellby Visa® Debit Card8: Round up your Wellby Debit Card purchases to automatically grow your savings or give back to charity.

Safeguard Your Identity & Finances

Protecting your identity and keeping your financial information secure is important, and a Wellby Secure Spending account empowers you to build lasting financial success with these added free premium benefits.

- Credit Score Tracker3: Keep an eye on your credit health daily with our in-app widget.

- IDProtect4: Free identity*, dark web*, social media*, and high-risk transactions monitoring*, and more, to keep your financial information safe and secure.

- Cell Phone Protection1: Up to $600 of replacement or repair cost for damaged or stolen phones.

- Overdraft Protection Options6: Life happens, and Wellby has your back.

A Free Checking Account that's Actually...Free

Managing your day-to-day finances should be simple, with no complex monthly service fees. Get all the tools, services, and capabilities you need with the free Wellby Secured Spending checking account.

Free High Yield Checking,

Premium Perks

Enjoy a high yield up to 4.50% APY*, no monthly service fees, Early Payday, and other premium perks with a Wellby Secure Spending account.

We Offer Advantages Like Never Before

Earn While Spending

Earn dividends while still enjoying no minimum balance or direct deposit requirements.

Early Payday

Access your direct deposit money up to two business days earlier.

Peace of Mind

Identity, credit activity, dark web, and high-risk transaction monitoring to keep your financial information safe and secure.

Early Payday

The only thing better than payday? Getting paid up to two days early! Get access to your money up to two business days earlier. The best part? There's no fees or additional costs, and no sign-up—just your hard-earned money in your hands sooner.

Early Payday FAQs

Get Paid Up to 2 Days Early!

Easy Money Transfers

Transfer funds between your accounts or to friends and family with our peer-to-peer services.

Banking Worldwide

Your Visa™ debit card is accepted wherever your adventures take you, so you can explore the globe without limits.

Debit Card Designs

Double Your Savings Rate

Earn Up to 3.56% APY* on Your Wellby Savings Plus Account

Pair your Wellby Savings Plus account with a Wellby Secure Spending checking account, and double your savings rate!

Earn Up to 3.56% APY* on Your Wellby Savings Plus Account

IDProtect Benefits

With IDProtect® Benefits4, a Wellby Secure Spending account provides you access to expanded identity monitoring services to keep your identity safe and secure.

- Access to Credit Score Tracker3 widget from your Wellby digital banking dashboard to keep an eye on your credit health daily and see changes in your credit score over time.

- Identity monitoring* of over 1,000 databases.

- Dark web*, social media*, and high-risk transactions monitoring*.

- Single bureau credit reports and credit score access3, plus daily credit file monitoring and automated alerts of key changes to your credit report.

- Access all your identity theft protection and recovery benefits with one click through the credit score widget on your dashboard.

Let's Get Started

You’re just a few clicks away from starting your new financial journey.

Let’s reach your dreams together.

Wellby Secure Spending FAQs

Want to know more about what the Wellby Secure Spending account can do for you? Check out our frequently asked questions.