February 6, 2025 | by Brian Truong

Understanding Lease Buy Out Loans: How you can Finance Your Leased Vehicle

December 1, 2023

By The Team at Wellby

The most recent peak in used car prices came in 2021 when consumers scrambled to purchase any type of vehicle, they could find due to fears of supply shortages related to COVID-19. While there has been some minimal relief from those record highs, we are far from being out of the woods. In fact, Barron's reports that used car prices are once again increasing at the fastest pace since 2021.

The most recent peak in used car prices came in 2021 when consumers scrambled to purchase any type of vehicle, they could find due to fears of supply shortages related to COVID-19. While there has been some minimal relief from those record highs, we are far from being out of the woods. In fact, Barron's reports that used car prices are once again increasing at the fastest pace since 2021.

This leaves many would-be vehicle owners left out in the rain as they simply cannot afford the asking prices that many used vehicles are going for these days. This has led many buyers in the market to turn to leasing vehicles while waiting for prices to fall back to more reasonable norms. With more people leasing vehicles, a common question comes to mind as our members near the end of their lease terms; can I buy this car at the end of my lease and what does that process look like?

The short answer is yes! You can often purchase a vehicle at the end of its leasing term through a “Lease buyout” and even receive financing for the vehicle through a “Lease buyout loan.” Today, we’ll discuss this option to help you better understand the process and determine if it’s the right option for you.

When Leasing a Vehicle is The Right Place to Start

Many individuals decide to lease a vehicle rather than buy one outright for a variety of reasons, including:

Many individuals decide to lease a vehicle rather than buy one outright for a variety of reasons, including:

- The Lack of a Down Payment - It is almost always necessary to put a down payment on a vehicle before you have the option to purchase it. However, coming up with the funds necessary to make a down payment is easier said than done. Depending on the value of the vehicle, the required down payment can range anywhere from a few hundred dollars to a few thousand dollars. Given that, many choose to lease a vehicle rather than attempt to purchase one.

- The Lack of Adequate Credit - Another key factor when applying for an auto loan is your credit score. Those who know that their credit score needs some work will often choose to lease their vehicle instead of trying to buy one. Ensuring your lease payments are made on time and in full can actually improve your credit overtime and help you gain approval or a better interest rate when it comes time to buy.

- Avoid the Risks of Depreciation - It is a well-known fact that vehicles lose value as they are used. Depreciation is a series consideration for any type of vehicle, and some individuals prefer to avoid taking on the financial toll of depreciation. Instead, they prefer to lease a vehicle.

These are just a few of the reasons why some people choose to lease a vehicle instead of purchasing it outright. That being said, there are ways that you can convert your leased vehicle into one that you purchase outright if the time is right and your lease term is coming to a close.

How a Vehicle Lease Can Transform Into Vehicle Ownership

If you are considering purchasing a vehicle you have been leasing up to this point, you should locate the paperwork you signed when you first agreed to the lease. It is likely that there are clauses that exist within your lease agreement that detail how you can go about financing the vehicle that you have been leasing up to this point.

If you are considering purchasing a vehicle you have been leasing up to this point, you should locate the paperwork you signed when you first agreed to the lease. It is likely that there are clauses that exist within your lease agreement that detail how you can go about financing the vehicle that you have been leasing up to this point.

It is likely the case that you will have the option to convert your lease to financed ownership either during the lease period or after the lease period ends. You will almost certainly pay less if you choose to finance the automobile after the lease term ends due to common early buyout fees and regulations in the contract.

By waiting until the end of your lease, you can avoid paying these early lease termination fees and other penalties. Therefore, while you technically have the option to finance your vehicle at any point while you are leasing the vehicle, you will do yourself a favor by waiting until the lease term is up before you finance it.

What to Do if You Just Can't Wait Until the Lease Period Expires

There are certain situations when it may be necessary to get out of your vehicle's lease and begin financing a vehicle right away. If you find yourself in a situation where terminating your lease immediately is necessary, you should explore financing a lease buyout. It’s best to discuss your situation with the dealership you leased the vehicle from and determine your final lease buyout price. This can include any early termination fees you may have to pay and can be added toward the total price you’ll finance through your lease buyout loan.

When working with your lending specialist, you can better tailor your lease buyout loan so the payments and term length can be structured in a way that will work best for you. If you’ve been making your lease payments on time and in the full amount, you may even qualify for a lower interest rate and could potentially lower your monthly payments to below the monthly cost of the lease, therefore saving you some money for your monthly budgets.

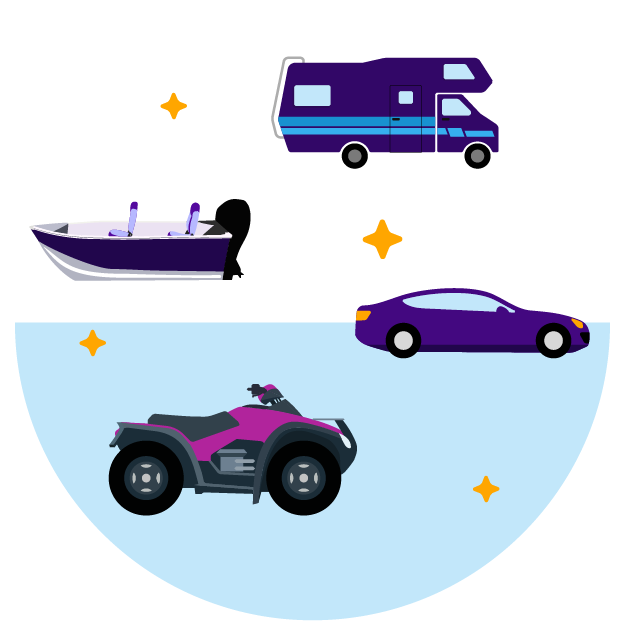

Can You Borrow Lease Buy Out Loans for All Types of Vehicles?

Believe it or not, there are lease buyout loan options for many different types of vehicles. These include:

Believe it or not, there are lease buyout loan options for many different types of vehicles. These include:

- Commercial Vehicles

- Recreational vehicles

- Boats and watercraft

- ATVs

Each loan type may come with its own unique set of terms and conditions. That’s why our lending specialists will work with you and guide your through each step of the process to ensure you understand the loan completely and answer any questions you may have.

While leasing a vehicle may have been the right choice for your financial plan in the past, we understand that many people who are leasing a car want to get out of their lease and step into full vehicle ownership. That’s why we strive to make the process as seamless and stress-free as possible. If you’ve been leasing your dream car, and parting with it at the end of your lease term is something you just can’t bear, remember that a lease buyout auto loan is an available option for you that can be very beneficial depending on your circumstances.

Related Topics

The Team at Wellby is a diverse group that is here to help you find the right financial solutions for your unique goals and budget. Our passion is people: our members, team members, and the communities we serve. We help people find solutions that support their financial well-being, allowing them to dream and prosper.

Related articles you might like

December 23, 2024 | by Brian Truong

Budgeting 101: Comparing Fixed and Variable Costs

December 12, 2024 | by Brian Truong