February 6, 2025 | by Brian Truong

Top 5 Ways to Improve Your Credit Score

March 11, 2024

By Chad Carpenter

A strong credit score is crucial for your financial success, especially in today's economic climate. A good rating demonstrates your financial responsibility and impacts many financial and life decisions. Maintaining a good credit score has several benefits, including easier credit approval, better negotiating power to secure lower interest rates and favorable loan terms, enhanced job prospects, ease of securing housing, and lower insurance premiums.

This post guides you on navigating your finances and rising above the unique challenges in today's economic landscape. More so if you're a Gen Z (ranked as the generation with the lowest credit score) looking for actionable advice on how to improve your credit score to unlock financial opportunities for your financial success.

Understanding Credit Scores

A credit score is a numerical prediction of your creditworthiness, usually ranging from 300 to 850. Derived from your credit reports using a scoring model, the rating aims to demonstrate your creditworthiness and financial responsibility, such as your ability to pay bills on time. This impacts many financial and life decisions, including employment, lending decisions, interest rates, insurance premiums, and rental applications.

A credit score is a numerical prediction of your creditworthiness, usually ranging from 300 to 850. Derived from your credit reports using a scoring model, the rating aims to demonstrate your creditworthiness and financial responsibility, such as your ability to pay bills on time. This impacts many financial and life decisions, including employment, lending decisions, interest rates, insurance premiums, and rental applications.

Credit bureaus are responsible for managing credit information. There are three major reporting agencies in the United States - Experian, TransUnion, and Equifax. Once you obtain credit, the information is stored with the credit bureaus and is used to calculate your credit score, which is categorized as follows:

- Excellent: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

Lenders generally consider a score of 700 and above good risk and may be open to offering better rates and terms.

The scoring model uses the following five components to calculate credit ratings:

- Payment history: Payment history accounts for 35% of your score. It evaluates your past credit accounts to determine how timely you pay your bills. Past late payments and how late they were impact your credit record negatively.

- Credit utilization: Credit utilization accounts for 30% of your FICO score. It represents the amounts you have borrowed and is expressed as a ratio of your revolving account balance to your available credit limits. A lower ratio is considered an indication of responsible credit management. High credit scores often have a utilization rate below 10%.

- Length of credit history: Length of credit history accounts for 15% of the score. It evaluates your experience in managing debt by considering the average age of your accounts.

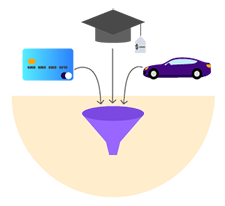

- Types of credit: Your credit mix accounts for 10% of the score. It assesses your ability to manage different types of installment and revolving credit, such as student loans, car loans, credit cards, and lines of credit.

- New credit: New credit accounts for 10% of your FICO score. It evaluates the number of recent applications or loan queries you've made. Too many recent applications could indicate financial distress and harm your score.

Typically, a higher credit rating indicates you’re less risk, and vice versa. A better score means lenders are more likely to approve your loan application and offer more favorable loan terms and lower interest. It also increases your lender options, allowing you to compare the rates and terms and settle for the most affordable credit.

Landlords also consider credit scores when evaluating rental applications and setting minimum security deposits. Having a good rating can give you an edge over other applicants. If you intend to purchase a house, a higher rating can increase your mortgage approval chances and secure better interest rates.

Your credit scores can also impact your auto, homeowners, and life insurance premiums, as providers consider credit scores when determining the rates. Similarly, when hiring, especially for positions that manage finances, employers often look at candidates' credit scores to assess their financial responsibility.

Pay Bills on Time

Loan and mortgage repayments, credit card payments, utility and medical bills are common financial obligations that can impact your credit rating as late payments reflect on your credit report. Falling back on payment of the bills due to financial constraints, forgetfulness, miscommunication, or any other reason affects your creditworthiness profile, limiting your ability to access affordable credit.

Loan and mortgage repayments, credit card payments, utility and medical bills are common financial obligations that can impact your credit rating as late payments reflect on your credit report. Falling back on payment of the bills due to financial constraints, forgetfulness, miscommunication, or any other reason affects your creditworthiness profile, limiting your ability to access affordable credit.

Paying bills on time consistently demonstrates your financial responsibility, which enhances your credit reputation and builds trust with lenders. Lenders consider you less risky, which gives you more leverage to bargain for lower rates and better credit terms.

If you struggle with paying bills on time, consider the following tips to ensure you don't miss the due dates:

- Set up payment reminders: Some people fail to pay bills on time due to forgetfulness. Consider setting reminders on your smartphone or computer to get alerts of upcoming payments and avoid missing the due dates.

- Create a budget: Lack of budgeting is a common cause for delayed payments. Creating a budget gives you a better understanding of your finances – income, and expenses – allowing you to plan and set aside funds to meet your obligations.

- Automate payments: Setting automatic payments is a convenient way of managing recurring bills. Most lenders and utility companies allow you to set automatic payments from your bank for direct remittance on the due dates.

- Build an emergency fund: Emergencies, though unexpected, are inevitable. Setting up an emergency fund provides a safety net, ensuring you have funds to pay bills on time in case of unforeseen financial interruptions.

Lower Credit Utilization Ratios

The credit utilization ratio is your credit balance divided by the available revolving credit account limit, expressed as a percentage. Revolving accounts include credit cards, personal lines of credit, and home equity lines of credit. A lower credit utilization ratio indicates responsible credit management, which means higher scores. For instance, if your credit card limit is $1,000 and you have a credit utilization of 10%, it means your credit balance is $100.

The credit utilization ratio is your credit balance divided by the available revolving credit account limit, expressed as a percentage. Revolving accounts include credit cards, personal lines of credit, and home equity lines of credit. A lower credit utilization ratio indicates responsible credit management, which means higher scores. For instance, if your credit card limit is $1,000 and you have a credit utilization of 10%, it means your credit balance is $100.

For better scores, you should keep the available credit high. Here are strategies you can leverage to achieve this:

- Pay off down balances

- Apply for a new credit card

- Ask for a credit limit raise

- Update your income regularly to qualify for a limit increase

- Keep your old credit cards

Diversify Your Credit Mix

Credit scoring assesses the credit mix for a comprehensive view of your payment history. This accounts for about 10% of your FICO score. While only a small percentage, a good credit mix enhances your chances of hitting the higher scores, which is considered less risky, e.g., by increasing your credit limit, which can help lower your credit utilization ratio. A diversified credit mix also provides financial flexibility, allowing you to explore different types of credit to meet your financial needs.

Credit scoring assesses the credit mix for a comprehensive view of your payment history. This accounts for about 10% of your FICO score. While only a small percentage, a good credit mix enhances your chances of hitting the higher scores, which is considered less risky, e.g., by increasing your credit limit, which can help lower your credit utilization ratio. A diversified credit mix also provides financial flexibility, allowing you to explore different types of credit to meet your financial needs.

Consider having a mix of installment loans and revolving credit. Installment loans include mortgage, student, personal, and auto loans. Revolving credit is loans offered on a limit basis, such as credit cards (bank or retail) and home equity lines of credit.

A diversified credit portfolio indicates your ability to manage different credit types, demonstrating your financial responsibility and boosting trust among lenders. However, it's vital to utilize the credit responsibly to avoid the risk of falling back on repayments. Here are tips that can help you with this:

- Embrace budgeting to maximize your resources

- Only borrow what you need

- Keep your available credit limit low – a credit balance of less than 10% is considered healthy, but if you spend more, keep it below 30%

Limit New Credit Inquiries

Hard inquiries affect your credit score. A hard inquiry is a query on your credit report initiated by a lender to establish your creditworthiness when you apply for credit. New credit inquiries are recorded on your credit report and can affect your credit scores for one year, though they remain on the record for two years. Making multiple loan applications often results in many hard inquiries, which might look like you're in financial distress, casting doubt on your ability to pay back.

Hard inquiries affect your credit score. A hard inquiry is a query on your credit report initiated by a lender to establish your creditworthiness when you apply for credit. New credit inquiries are recorded on your credit report and can affect your credit scores for one year, though they remain on the record for two years. Making multiple loan applications often results in many hard inquiries, which might look like you're in financial distress, casting doubt on your ability to pay back.

The only exception is when shopping for a mortgage or auto loan. Credit reporting agencies assume you're researching multiple providers to compare the rates and terms and often capture inquiries made within 14 to 45 as one inquiry.

While having multiple credits benefits your score, you should space out your loan and credit applications to avoid the negative impact of hard inquiries. Consider analyzing your financial goals before making an application. For example, if you plan to take a mortgage soon, you may want to avoid applying for a new credit card. The spacing may vary, but consider waiting at least three to six months between applications.

Regularly Review Your Credit Reports

Monitoring your credit reports regularly is vital in maintaining a healthy credit rating. It helps identify errors or fraudulent activities that could negatively impact your score, enabling you to report the discrepancies for prompt correction. Regular monitoring also allows you to understand your creditworthiness and identify areas for improvement to meet your future financial needs. This is especially important when preparing for major financial decisions like buying a car or home.

Monitoring your credit reports regularly is vital in maintaining a healthy credit rating. It helps identify errors or fraudulent activities that could negatively impact your score, enabling you to report the discrepancies for prompt correction. Regular monitoring also allows you to understand your creditworthiness and identify areas for improvement to meet your future financial needs. This is especially important when preparing for major financial decisions like buying a car or home.

The Fair Credit Reporting Act (FCRA) entitles you to one free annual credit report from each of the three credit reporting companies—Experian, TransUnion, and Equifax. You can get the free report by visiting the AnnualCreditReport.com website, filling out the form, selecting the reports you want, and submitting the request. You can also get a free report by visiting individual bureau websites.

If you discover errors in the report, you can file a dispute as follows:

- Visit the dispute center of the relevant credit bureau – Experian, TransUnion, or Equifax – and file a dispute. Each company provides the option of disputing online, by mail, or by phone.

- Once you submit the dispute, the credit reporting company investigates and liaises with the furnisher.

- The furnisher makes the necessary corrections and notifies the bureau.

- In addition, file a dispute with the furnisher (original reporter) – bank, credit card company, etc.

Proactive credit management is vital in unlocking your financial opportunities and achieving financial goals. Learning how to improve your credit score is a good starting point on your journey to financial success. An impressive credit rating significantly impacts lending decisions, interest rates, insurance premiums, and securing housing and employment.

Making informed, consistent actions – paying bills on time, lowering your credit utilization ratio, diversifying your credit mix, limiting new credit inquiries, and regularly reviewing your credit reports – is crucial to building and maintaining a strong credit score over time.

Related Topics

Chad Carpenter hails from Dallas, Texas, and lived in Denver, Colorado, for 15 years before landing in Houston. Chad has over 20 years of marketing and SEO experience, including several years in the agency world. When he’s not clacking away on his keyboard optimizing Wellby's digital presence, digging into data, or immersed in AI, Chad enjoys good food, good friends, and good movies (just don’t expect him to watch any in interactive 4D). Chad has two cats, one that loves him and one who is aloof.

Related articles you might like

December 23, 2024 | by Brian Truong

Budgeting 101: Comparing Fixed and Variable Costs

December 12, 2024 | by Brian Truong