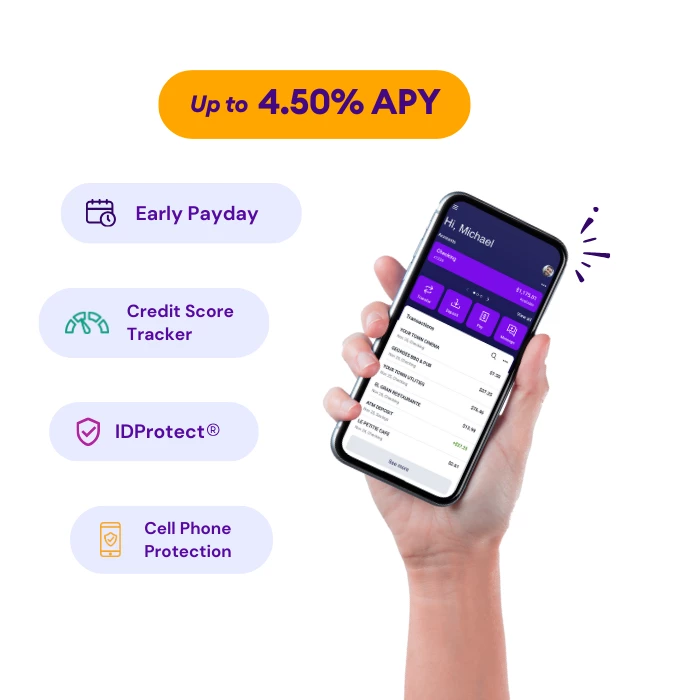

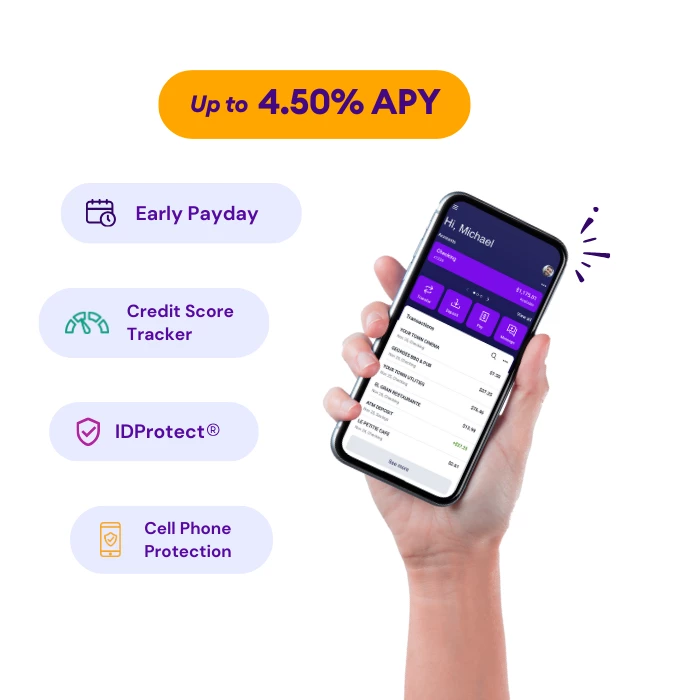

Free High Yield Checking, Premium Perks

Your key to financial prosperity

Our free, high yield Secure Spending checking account is designed to empower you and build lasting financial success. It’s not just the basis of banking—it’s your key to financial prosperity.

Free Premium Perks You’ll Love

- High Yield Advantage1: Earn up to 4.50% APY on Secure Spending balances up to $50,000 by making 30 point-of-sale (POS) Wellby Debit or Credit Card transactions monthly.

- No Monthly Service Fees: Your money stays with you – where it belongs.

- Early Payday2: Celebrate payday up to 2 business days early at no extra charge.

- Credit Score Tracker3: Keep an eye on your credit health daily with our in-app widget.

- IDProtect4: Free identity*, dark web*, social media*, and high-risk transactions monitoring*, and more, to keep your financial information safe and secure.

- Cell Phone Protection5: Up to $600 of replacement or repair cost for damaged or stolen phones.

- Overdraft Protection Options6: Life happens, and Wellby has your back.

- Bundle & Save7: Pair your Wellby Secure Spending checking account with a Wellby Savings Plus account to double your savings rate and earn up to 3.56% APY**.

- Save the Change with a Wellby Visa® Debit Card8: Round up your Wellby Debit Card purchases to automatically grow your savings or give back to charity.

Opening Your Wellby Secure Spending Account is Easy:

- Complete the online application in minutes.

- Verify your information.

- Begin using your new checking account, Wellby Debit Card, and enjoy all the member benefits Wellby has to offer.

Open your free high yield checking account today, and start your journey to financial prosperity.

Early Payday

The only thing better than payday? Getting paid up to two days early! Get access to your money up to two business days earlier. The best part? There's no fees or additional costs, and no sign-up—just your hard-earned money in your hands sooner.

Get Paid Up to 2 Days Early!

*Registration/activation required

Other fees may apply

1APY= Annual Percentage Yield. Must be at least 18 years of age to open Secure Spending account. High Yield Requirements for this account include: You MUST have a minimum of 30 debit card Point-of-Sale (POS) transactions or 30 credit card POS transactions, or a combination of 30 debit and credit card POS transactions monthly. [A transaction is considered a Point-of-Sale (POS) transaction when you use your debit or credit card online, or physically at a POS register via tap, swipe, or insert.] The highest APY includes: 4.50% APY on account balances up to $50,000.00, and 0.03% APY on account balances greater than $50,000.00. If requirements are unmet, accounts will earn 0.03% APY on account balances. Rates are subject to change. APY rate is effective as of 10/1/2024. Fees could reduce earnings on the account.

2Early Payday gives you access to your eligible direct deposits up to two (2) business days before the scheduled payment date to your personal account. Early availability is not guaranteed and may vary from deposit to deposit, which depends on when we receive the payor’s instructions and other limitations such as fraud screening. Eligible direct deposits include your payroll, pension, and government benefit payments made through the Automated Clearing House (ACH). Other deposits or credits such as deposits of funds from person-to-person payment services (i.e., Cash App, Zelle®, Venmo, or PayPal transfers), check or mobile deposits, and other online transfers or electronic credits are not eligible for Early Payday.

3You will have access to your credit report and score provided your information has been verified by the credit reporting agency (CRA). Credit score is a VantageScore 3.0 based on Transunion data. Third parties may use a different type of credit score to assess your creditworthiness.

4Benefits are available to personal checking account owner(s), and their joint account owners subject to the terms and conditions for the applicable Benefits. Some Benefits require authentication, registration and/or activation. Benefits are not available to a “signer” on the account who is not an account owner or to businesses, clubs, trusts, organizations and/or churches and their members, or schools and their employees/students covered.

5Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the insurance document. Guide to Benefit and insurance documents can be accessed through the Wellby Mobile app or online banking. Insurance products are not insured by the NCUA or any federal government agency, not a deposit of or guaranteed by the credit union or any credit union affiliate.

6Overdraft Protection Options: Wellby offers our members three options within our Overdraft Services Program to help pay overdrafts when they occur and prevent the decline and return of certain transactions: Wellby Overdraft Protection, Wellby Overdraft Steward, and Wellby Overdraft Steward with Debit Card Coverage.

Overdraft Protection is an optional service that allows you to link a Wellby savings account or a line of credit as a backup in case accidental overdrafts occur. When an overdraft occurs on your checking account, the exact amount needed to prevent the overdraft is transferred from your linked account with no additional transfer fee, ensuring enough funds are available. There is no charge for this service transfer. If the designated backup account does not have sufficient available balance to cover the full overdraft amount, and you are not opted into other overdraft services programs, Wellby may returns the transaction, and assess an Insufficient Funds (NSF) fee to your checking account as detailed in the Wellby Fee Schedule. You will have forty-five (45) days to re-pay any overdrawn balance.

Wellby Overdraft Steward can pay overdrafts on checks and Automated Clearing House (ACH) transactions (e.g., transactions using Wellby Bill Pay, recurring payments such as phone bills, mortgages or utility bills set up using your account and routing number) for a fee, when there is not a sufficient available balance in your eligible Wellby checking accounts up to a certain limit amount, for which you must meet certain criteria. This service is DISCRETIONARY, and Wellby does NOT GUARANTEE payment of your overdraft transaction. Additionally, we will not authorize and pay overdrafts for ATM withdrawals, over-the-counter withdrawals, and internal transfers initiated through online banking and telebanking and may not authorize and pay overdrafts for Point-of-Sale (POS) Debit Card transactions. You must enroll in the Overdraft Steward Debit Card Coverage to authorize payment of overdrafts for POS Debit Card Transactions. If you do not have a sufficient available balance to cover the full overdraft amount, Wellby may return the ACH or check items as unpaid, and assess an Insufficient Funds (NSF) fee as detailed in the Wellby Fee Schedule. You will have forty-five (45) days to re-pay any overdrawn balance.

Wellby Overdraft Steward with Debit Card Coverage is an optional service that will cover one-time Point-of-Sale (POS) Debit Card transactions for a fee of when there is not a sufficient available balance in your eligible Wellby checking accounts up to a certain limit amount, for which you must meet certain criteria. We will not authorize and pay overdrafts for ATM withdrawals, over-the-counter withdrawals, and internal transfers initiated through online banking and telebanking and may not authorize and pay overdrafts for Point-of-Sale (POS) Debit Card transactions. You must enroll in the Overdraft Steward Debit Card Coverage to authorize payment of overdrafts for POS Debit Card Transactions. We will charge a fee of $25.00 each time we pay a transaction using this Overdraft Steward coverage. If you are not opted-in to the Overdraft Steward service, we will DECLINE the Point-of-Sale (POS) Debit Card transaction, and assess an Insufficient Funds (NSF) fee as detailed in the Wellby Fee Schedule. You will have forty-five (45) days to re-pay any overdrawn balance.

For eligibility and more detail on Overdraft coverage programs see here: Disclosures | Wellby.

7Savings Plus Bonus Rate Offer: This offer is subject to change without notice. Wellby has the right to cancel or change this promotion at any time.

**APY = Annual Percentage Yield. APY is accurate as of 5/1/2025. The APY is a percentage rate that reflects the total amount of dividends to be paid on an account based on the dividend rate and frequency of compounding for an annual period. Dividend rates and APY for a Savings Plus account are variable and can change at any time. The NCUA insures individual accounts up to $250,000.00.

**To qualify for the bonus rate, you must have an active checking account and receive at least $300.00 in aggregate direct deposits per month; registering for and accessing online banking at least once every three (3) months, and one of the following: eight (8) or more posted debit card transactions or posted debit card payments of a bill from your Wellby checking account per month; eight (8) or more posted credit card transactions from your Wellby credit card account per month; or $40,000.00 or more in lending balances (does not include credit cards). If the checking account no longer qualifies as active, you will receive the regular posted rate for your savings balance tier. A savings account with a starting balance of $1,000.00 and a monthly deposit of $300.00 for 12 months at a bonus rate of 1.51% APY will earn $44.51. Fees could reduce earnings on the account.

8Learn more about Save the Change here.

A Primary Savings account is required for new members, which includes membership share and has a minimum balance of $5.00 to open the account.

JSC Federal Credit Union does business as Wellby Financial ("Wellby Financial" or "Wellby"). By doing business with Wellby Financial, you acknowledge that you are doing business with JSC Federal Credit Union. This offer is subject to membership eligibility. You are eligible if you live, work, worship, attend school, or do business in the Greater Houston Metro or Galveston area. You can also join Wellby if you are an employee or member of one of the 2,000+ companies, organizations, churches, homeowners’ associations, or areas of community service in our field of membership or are an American Consumer Council member. You may also be eligible to join if you are an immediate family member or live in the same household as a current Wellby member.