April 8, 2024 | by Brian Truong

3 Steps to Create a Monthly Budget After College

July 12, 2022

By Brian Truong

Try as you might to put it out of your head, your college days will eventually draw to an end. You likely feel a mixture of anticipation and uncertainty as you leave behind the life that you have grown accustomed to in order to head into a more unknown world.

It's natural to have some apprehension about it all, but you shouldn't allow these worries to keep you from making plans for your future. Instead, create a plan and set a budget, so you can face your next set of challenges in a constructive way and be better prepared financially for your life after college.

In this article, we're going to discuss three steps you should take toward building your personal budget for life after graduation. This can help you start your next chapter on the right foot and a better understanding of your changing finances.

1. Review Your Monthly Take-Home Pay

If you have a job now or if you anticipate having a job soon after you graduate, you should take into consideration the rate of take-home pay that you will make on a monthly basis. This figure represents the amount of income that you will need to make last throughout the entire month.

If you have a job now or if you anticipate having a job soon after you graduate, you should take into consideration the rate of take-home pay that you will make on a monthly basis. This figure represents the amount of income that you will need to make last throughout the entire month.

Remember, your take-home pay is the amount of money that is deposited into your bank account after all deductions have been factored in. Deductions from a paycheck may include:

- Federal income tax

- State income tax

- Social security

- 401(k) contributions

- Insurance

- Voluntary deductions taken for tax purposes

- Misc. charges for supplies, uniforms, etc.

The amount of money left over after all of these deductions have been subtracted from your paycheck is your take-home pay.

It's important to know what your take-home pay is each month in order to best understand what kind of lifestyle you can reasonably expect to build for yourself going forward. This includes monthly payments you can afford for things like rent, car payments, or a mortgage, as well as variable expenses, which we'll talk about in more detail shortly. By knowing what your take-home pay is, you can set reasonable expectations for yourself and also look for ways to grow your income going forward.

2. Create a List of Expenses

When creating a budget, start with your list of expenses to see how much you spend on various things right now in order to figure out where you can make some cuts if needed.

When creating a budget, start with your list of expenses to see how much you spend on various things right now in order to figure out where you can make some cuts if needed.

When looking through your expenses, you will want to break them down into two categories: fixed expenses and variable expenses. Both are essential to look over because they will both have an impact on your overall budget and how much you may have left over at the end of each month.

Fixed expenses cost roughly the same amount each month, cannot easily be changed, and are usually paid on a regular monthly basis. Examples of fixed expenses include the following:

- Rent

- Car payments

- Insurance payments

- Utilities

- Phone bills

Variable expenses are expenses that can change month to month. They are also the type of expense that you can potentially trim back on to some degree if you need to free up some budget for your fixed expenses. Examples of this type of expense include:

- Shopping

- Travel

- Dining Out

- Entertainment

- Gas and parking fees

These categories are worth some extra scrutiny as you work your way through the list. Perhaps there are ways that you can cut back on some of the luxuries in order to save some of your monthly income to create an emergency fund or build toward a down payment on a car or home.

3. Practice the 50/30/20 Rule

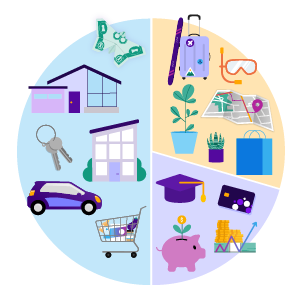

The 50/30/20 rule is a common budgeting tactic to help ensure you have enough budget each month to cover all of your expenses while still having some left over for savings. It's simply a way of looking at how to use the income that you make in a more measured way. This budget guideline breaks it down like this:

The 50/30/20 rule is a common budgeting tactic to help ensure you have enough budget each month to cover all of your expenses while still having some left over for savings. It's simply a way of looking at how to use the income that you make in a more measured way. This budget guideline breaks it down like this:

The 50/30/20 rule is a budgeting strategy where you spend 50 percent of your income on essential needs, 30 percent on wants and 20 percent on savings.

The purpose of placing your expenses in buckets like this is to help ensure that a certain percentage of the money goes into each bucket. You do NOT want to overextend your spending on any one category. At the same time, you don't want to have such a tight grip on your budget that you don't have the opportunity to allow yourself to let loose at any point in time and enjoy life a little.

The 50/30/20 rule helps you find the right balance to cover your living expenses, enjoy the things you love, and save some money for a future goal or rainy day. We'll look at examples of the types of things one might spend on under each category.

Essential Spending or "Needs" (50%)

This is the portion of your budget used for essentials that are often found in your "fixed expenses" list, such as rent, groceries, utilities, insurance, etc. It is the type of spending that is necessary and cannot be removed from the budget.

While many may not look forward to these bills arriving each month, essential spending can be very exciting as, oftentimes, these expenses help you take some concrete steps toward independence in your post-college days.

Discretionary Spending or "Wants" (30%)

Discretionary spending generally includes leisure activities. These are the things that we all spend on to bring some fun and joy into our lives. For example, one might spend some of their discretionary budgets on a trip to the movies, a gym membership, or the latest video game. Whatever the case is, this 30% is meant to be allotted to the enjoyable things that you want in life but don't necessarily need.

Savings (20%)

The final budget bucket is saving at least 20% of your income as an emergency fund in case of unexpected expenses or a loss of income. This will help you create a cushion that allows you to keep your head above water should something go wrong. This section of your budget can also be used to pay off debt, like student loans, quicker if you choose.

Discover a Budgeting Strategy That Works for You

You need to work on finding a budgeting strategy that works for you. The 50/30/20 rule is a great start and works for many people, but you may discover that it is not the one for you. You can still make great strides toward your goals as long as you find the path that works for you.

Many people go through several rounds of trial and error with different budgeting strategies until they find one that appeals to them. Do not be afraid to sample different strategies until you land upon the one that settles in just right with you. Once you have landed on the right one, practice it every day until you get more and more comfortable with it.

If you're unsure what works for you or how to get started on your budgeting and savings journey, Wellby is here to assist you with creating your savings plan and goals, paying bills online, and many other areas that can help you start your next chapter on the right foot.

Brian Truong was born in Canada (cool, eh?) and grew up in Sugar Land, Texas. Brian has over 12 years of SEO and marketing experience in a wide array of industries, including finance and real estate. When he’s not flexing his SEO and web development superpowers, he enjoys video games, anime, horror movies, and spending time with his cat, Chi.

Related articles you might like

March 11, 2024 | by Chad Carpenter

Top 5 Ways to Improve Your Credit Score

January 30, 2024 | by Team Wellby